First-time homebuyers are stepping into 2026 facing a market that’s shifting, but still far from easy.

The end of 2025 saw mortgage rates dip to their lowest level in fourteen months, but they remain elevated by recent historical standards. At the same time, homeowners insurance premiums and property taxes continue to rise nationwide. When you layer in the persistent gap between wages and home prices affordability remains a central pain point for new buyers, particularly first-timers who typically lack equity and funds for down payments and closing costs.

Still, today’s market isn’t uniformly bleak. In many mid-sized metros, home prices have stabilized, commutes are manageable, and cost of living pressures are far lower than in major coastal hubs. These pockets of opportunity are where first-time buyers can find a realistic path to ownership without sacrificing quality of life.

What Makes a City Great for a First-Time Homebuyer?

A city earns a spot on our list by excelling in two areas: affordability and quality of life.

Affordability means that total monthly housing costs (mortgage principal and interest, PMI, property taxes, and homeowners insurance) stay below 35% of the area's median household income. We also factored in broader cost of living expenses, including utilities, food, transportation, and healthcare.

To ensure that our cities offered perks beyond just the sticker price, we considered quality-of-life factors including crime rates, unemployment rates, commute times, average childcare costs, home appreciation potential, and entertainment options.

Finally, every city on our list has a principal city population of at least 115,000, ensuring access to jobs, amenities, and community.

See our methodology.

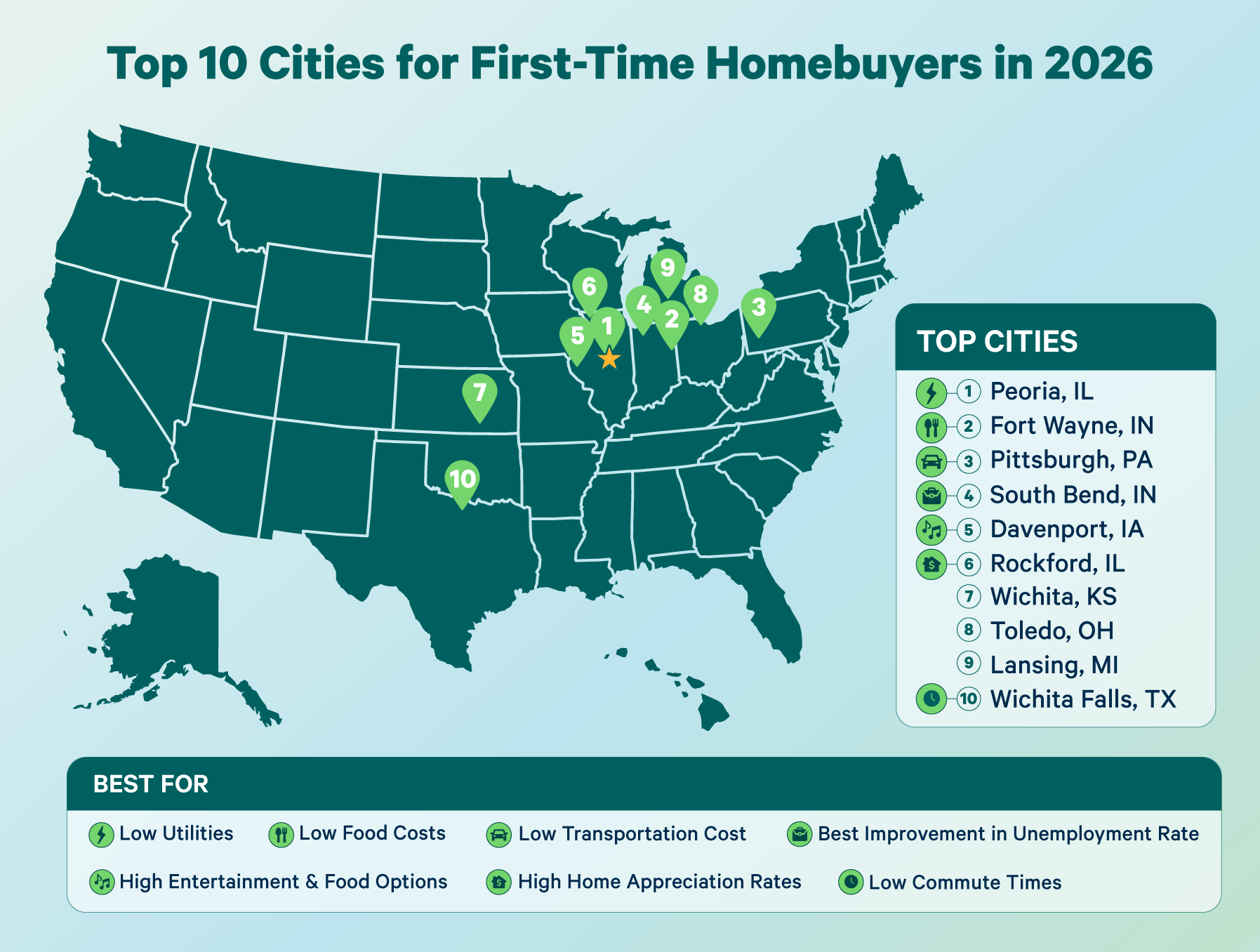

Top 10 Cities for First-Time Homebuyers in 2026

Here are the top 10 cities where first-time buyers can get the most long-term value from their housing dollars in 2026.

1. Peoria, IL

Median Home Price: $161,868

Median Monthly Housing Cost: $1,492

Housing Cost as Percent of Income: 25%

Peoria tops our list by pairing some of the lowest cost of living scores with the strongest overall quality-of-life score in the study. Housing costs stay comfortably under the 35% threshold, giving buyers breathing room in their budgets. From 2022 to 2025, home values rose about 18.4%, a sign of solid momentum without runaway price growth. The unemployment rate changed only about +0.1 percentage points between January and August 2025, pointing to a relatively stable job market. Commutes are short for most residents, and childcare costs remain on the more affordable end of our top 10, making Peoria especially appealing for first-time buyers looking to balance day-to-day expenses with long-term stability.

Jobs & Market Snapshot

Peoria’s economy is anchored by healthcare, manufacturing, and professional services and major employers include OSF HealthCare, Caterpillar, and UnityPoint Health.

Neighborhoods Worth Knowing

West Peoria: historic homes, river views, close to downtown.

Germantown Hills: older homes, parks, convenient access to employers.

East Bluff: affordable homes near riverfront amenities.

North Peoria: newer subdivisions, shopping centers, strong schools.

Peoria, IL Hotspots Cultural Hotspots Nature Highlights - Peoria Riverfront Museum

- Civic Center & Theater District

- Warehouse District (restaurants, breweries, art)

- Forest Park Nature Center

- Grandview Drive & Park

- Wildlife Prairie Park

- Peoria Riverfront Trail

2. Fort Wayne, IN

Median Home Price: $246,963

Median Monthly Housing Cost: $1,880

Housing Cost as Percent of Income: 33%

Fort Wayne earns the second spot with a strong quality-of-life score and solid housing fundamentals. Monthly ownership costs push closer to the upper end of our affordability range, but buyers get a lot in return. From 2022 to 2025, home values increased about 15.5%, and the unemployment rate improved by roughly 0.3 percentage points between January and August 2025. Combined with relatively low childcare costs, that makes for a solid foundation. Commutes are short, and Fort Wayne’s expanding downtown and park systems give first-time buyers a chance to plant roots in a market with long-term upside.

Jobs & Market Snapshot

The local economy is diversified across healthcare, advanced manufacturing, defense, logistics, and financial services. Parkview Health, Lutheran Health Network, General Motors, and Lincoln Financial Group anchor regional employment.

Neighborhoods Worth Knowing

West Central: historic homes, walkable, near downtown.

Northside: established neighborhoods and parks.

Historic Northeast: affordable homes, walkable, with easy access to shops.

Aboite: suburban-style living with green space.

Fort Wayne, IN Hotspots Cultural Hotspots Nature Highlights - Downtown Arts Campus & Embassy Theatre

- The Landing dining district

- Botanical Conservatory

- Electric Works redevelopment

- Promenade Park

- Fort Wayne Trails network

- Headwaters Park

- Fox Island County Park

3. Pittsburgh, PA

Pittsburgh gives first-time buyers access to a large metro at a manageable price point. Housing costs sit just under the 35% threshold, while cost of living metrics remain favorable compared to coastal job hubs. From 2022 to 2025, home values rose about 7.6%, reflecting steady appreciation rather than boom-and-bust swings. The unemployment rate edged up only about 0.3 percentage points between January and August 2025, suggesting a fairly resilient labor market.

Major universities, including the University of Pittsburgh and Carnegie Mellon University, drive innovation, medical research, and high-paying jobs.

Pittsburgh’s identity also rests on its strong sports culture, with the Steelers, Penguins, and Pirates fostering community and pride. Childcare costs are among the more affordable in our top 10, and the mix of research institutions, sports energy, and revitalized neighborhoods gives buyers a well-rounded urban option with long-term stability.

Jobs & Market Snapshot

Pittsburgh’s economy is driven by healthcare, education, finance, and technology. Key employers include UPMC, Allegheny Health Network, the University of Pittsburgh, Carnegie Mellon University, and PNC Financial Services.

Neighborhoods Worth Knowing

Shadyside: walkable, historic homes, boutiques.

Lawrenceville: trendy, artsy, renovated rowhomes.

Squirrel Hill: tree-lined, diverse dining, strong community amenities.

Regent Square: walkable, great restaurants, tree-lined streets.

| Pittsburgh, PA Hotspots | |

| Cultural Hotspots | Nature Highlights |

|

|

4. South Bend, IN

Median Home Price: $221,658

Median Monthly Housing Cost: $1,738

Housing Cost as Percent of Income: 32%

South Bend ranks highly as an affordable college town with improving job trends and strong home appreciation growth. From 2022 to 2025, home values increased about 15.3%, giving buyers upside without extreme volatility. The unemployment rate improved by roughly 0.9 percentage points between January and August 2025, one of the better shifts in our top 10. The median housing costs land above some neighbors on the list, but childcare and commute scores fall in the middle of the pack, giving the region a balanced appeal. For buyers seeking a stable job base anchored by a major university ecosystem, this metro offers strong value.

Jobs & Market Snapshot

Top employers include the University of Notre Dame, Beacon Health System, AM General, and manufacturers throughout the South Bend–Elkhart corridor.

Neighborhoods Worth Knowing

River Park: historic homes located along the St. Joseph River.

Sunnymede: historic homes, tree-lined, close to downtown.

Downtown South Bend: walkable with river access, restaurants, and galleries.

Twyckenham Hills: quiet, family-friendly, with access to parks.

| South Bend, IN Hotspots | |

| Cultural Hotspots | Nature Highlights |

|

|

5. Davenport, IA

Median Home Price: $183,689

Median Monthly Housing Cost: $1,680

Housing Cost as Percent of Income: 28%

Davenport offers Mississippi River scenery, paired with a reasonable entry cost for first-time buyers. Housing costs sit well below the 35% threshold, and commute times outperform those of many other metros in the study. From 2022 to 2025, home values rose by about 7.6%, a slower but steady pace compared to some of its peers. The unemployment rate increased by roughly 0.5 percentage points between January and August 2025, reflecting some softening in the labor market. Childcare costs trend higher than the average, but the region remains a stable option, offering riverfront recreation and small-city accessibility.

Jobs & Market Snapshot

Davenport’s economy is anchored by manufacturing, defense, logistics, and healthcare. Major employers include John Deere, Rock Island Arsenal, and Genesis Health System.

Neighborhoods Worth Knowing

McClellan Heights: historic homes, winding streets, hillside charm.

Village of East Davenport: boutiques, dining, community events.

Vander Veer Park: classic homes, tree-lined streets, near gardens.

Hamburg Historic District: vintage architecture, quirky, walkable.

| Davenport, IA Hotspots | |

| Cultural Hotspots | Nature Highlights |

|

|

6. Rockford, IL

Median Home Price: $206,734

Median Monthly Housing Cost: $1,891

Average Housing Cost as Percent of Income: 34%

Rockford takes the sixth spot in our rankings thanks to a strong combination of housing affordability and quality-of-life metrics. From 2022 to 2025, home values climbed about 28.9%, the steepest appreciation in our top 10. Despite this, the median home price in Rockford stayed well under the national median of $360,727. The unemployment rate improved by roughly 0.1 percentage points between January and August 2025, and Rockford stands out for having the best childcare affordability in the top 10. Its share of short commute times also ranks well above average, giving first-time buyers both financial and lifestyle breathing room.

Jobs & Market Snapshot

Rockford’s economy is rooted in advanced manufacturing, aerospace, logistics, and healthcare. Key industries include healthcare, aerospace, and advanced manufacturing. Major employers: OSF HealthCare, Mercyhealth, Collins Aerospace, and Woodward.

Neighborhoods Worth Knowing

Churchill’s Grove: historic homes, walkable.

Edgewater: riverside access, strong community feel.

Signal Hill: character homes, convenient location.

Rolling Green: affordability and active neighborhood association.

| Rockford, IL Hotspots | |

| Cultural Hotspots | Nature Highlights |

|

|

7. Wichita, KS

Median Home Price: $214,523

Median Monthly Housing Cost: $1,939

Housing Cost as Percent of Income: 34%

Wichita pairs a relatively low cost of living with one of the stronger quality-of-life scores in our top 10. Housing costs sit high in the affordability range, but buyers benefit from extremely short commutes and a diversified job market anchored by aerospace and healthcare. From 2022 to 2025, home values rose about 13.0%, and the unemployment rate changed only about +0.1 percentage points between January and August 2025, suggesting a generally stable labor picture. Childcare costs fall in the mid-range. Overall, Wichita offers a strong blend of affordability, job access, and outdoor recreation.

Jobs & Market Snapshot

Aerospace, advanced manufacturing, healthcare, agriculture, and energy drive the economy. Spirit AeroSystems and Textron Aviation anchor the aviation sector.

Neighborhoods Worth Knowing

College Hill: historic homes, dining, parks.

Riverside: charming homes, parks, museums, and riverside access.

Maize Proper: family-friendly, top-rated schools, suburban.

Delano District: walkable, entertainment near downtown.

| Wichita, KS Hotspots | |

| Cultural Hotspots | Nature Highlights |

|

|

8. Toledo, OH

Median Home Price: $194,680

Median Monthly Housing Cost: $1,605

Housing Cost as Percent of Income: 30%

Toledo offers a balanced mix of affordability and amenities, with monthly housing costs landing well under the 35% threshold. Cost of living metrics remain favorable compared to larger Great Lakes cities. From 2022 to 2025, home values increased by about 15%, and the unemployment rate rose by roughly 0.5 percentage points between January and August 2025. Short commutes, strong parks, and an improving downtown make Toledo attractive for first-time buyers seeking value and access to major manufacturing and healthcare employers.

Jobs & Market Snapshot

Toledo’s job market is anchored by manufacturing, automotive, healthcare, and materials. Major employers include ProMedica, Owens Corning, and automotive suppliers.

Neighborhoods Worth Knowing

Old West End: historic homes, arts community.

Perrysburg: lofts, dining, riverfront events.

West Toledo: established neighborhoods, schools.

Point Place: waterfront access and coastal feel.

| Toledo, OH Hotspots | |

| Cultural Hotspots | Nature Highlights |

|

|

9. Lansing, MI

Median Home Price: $238,495

Median Monthly Housing Cost: $2,000

Housing Cost as Percent of Income: 34%

Lansing stands out for its stable job base and vibrant university-driven environment. Monthly housing costs approach the top of our affordability range, and the cost of living ranks higher than in any other city on the list. In return, buyers access healthy home price growth and strong employment anchors.

From 2022 to 2025, home values rose about 13.8%, and the unemployment rate increased by roughly 0.4 percentage points between January and August 2025. Short commutes and a deep talent pool tied to Michigan State University and state government offer long-term employment stability and cultural amenities.

Jobs & Market Snapshot

Lansing’s economy is driven by state government, higher education, insurance, healthcare, and automotive manufacturing. Major employers include the State of Michigan, Michigan State University, Sparrow Health, Auto-Owners Insurance, and General Motors.

Neighborhoods Worth Knowing

Downtown Lansing: condos, riverfront living.

Old Town: arts district, historic character.

Okemos: walkable suburban center near MSU with a mix of home types.

REO Town: revitalizing with cafés and creative spaces.

| Lansing, MI Hotspots | |

| Cultural Hotspots | Nature Highlights |

|

|

10. Wichita Falls, TX

Median Home Price: $169,458

Median Monthly Housing Cost: $1,666

Housing Cost as Percent of Income: 31%

Wichita Falls offers some of the shortest commute times and lowest living costs in the entire study. Housing costs sit below 35% of income, and day-to-day expenses remain relatively low. From 2022 to 2025, home values rose about 2.8%, a modest pace compared to other metros in the top 10, but that also helps keep entry costs accessible. The unemployment rate held essentially flat between January and August 2025, signaling a steady job market anchored by Sheppard Air Force Base. Buyers drawn to affordability, outdoor recreation, and small-city community life may find Wichita Falls a great fit.

Jobs & Market Snapshot

Wichita Falls’ job base centers on military, healthcare, education, and manufacturing. Major employers include Sheppard Air Force Base, United Regional Health Care System, and regional manufacturing and service firms.

Neighborhoods Worth Knowing

Downtown Wichita Falls: lofts, historic buildings, events.

Faith Village: established homes, parks.

Eden Hills: affordable homes, quiet, tree-lined.

Ninth Street: quiet, residential, close community feel.

| Wichita Falls, TX Hotspots | |

| Cultural Hotspots | Nature Highlights |

|

|

Our Methodology

All cities had to have an average housing cost (mortgage principal and interest, PMI, property taxes, and homeowners insurance) that did not exceed 35% of the area’s median household income. We assumed a 30-year mortgage at a rate of 6.25% with a 10% down payment. PMI was estimated at 0.75% of the loan amount.

After these requirements, we ranked cities using a combination of Cost of Living (COL) and Quality of Life (QOL) indices. The most recent reliable data was used whenever possible.

Cost of Living Factors:

Average Utility Cost Per Household By State (2024 to 2025)

Average Food Cost Using the USDA Low-Cost Plan (2024)

Average Transportation Cost including Auto Ownership, Auto Use, and Transit Use (2022 to 2023 values, inflated for 2025)

Average Health Insurance Costs (2024)

Average Childcare Costs (2022 to 2025)

Cost of living factors were normalized and weighted into a composite COL Index.

Average health insurance costs, childcare expenses, transportation costs, and food costs are assumed for a household with two adults and two children (ages 4 and 8).

Quality of Living Factors:

Change in Unemployment Rate (August 2024 to August 2025)

Percent of Commutes Under 25 Minutes (2024)

Median Home Appreciation (October 2022 to October 2025)

Entertainment and Food Venues Per 10,000 People (2023)

Reported Violent Crime Per Capita (2024)

Reported Property Crime Per Capita (2024)

Quality of living factors were normalized and weighted into a composite QOL Index.

Population Requirement

All cities had to have a population of at least 115,000 residents.

Data sources: Zillow, U.S. Census Bureau American Community Survey (ACS) & County Business Patterns (CBP), The Tax Foundation, U.S. Bureau of Labor Statistics, Economic Policy Institute (EPI), Move.org, NerdWallet. Home values as of October 31, 2025.