USDA Loans Homebuying Guide

If you're looking to buy a home in a rural or suburban area, a USDA loan could be a great option. In this guide, we'll cover everything you need to know about USDA loans, including how they work, who qualifies, and what types of homes are eligible.

What is a USDA loan?

A USDA loan, also known as a rural development loan, is a type of mortgage offered through the U.S. Department of Agriculture's Rural Development program. Created in 1937, the program is designed to help low- to moderate-income buyers purchase homes in eligible rural and suburban areas.

USDA loans offer great benefits, including lower interest rates than conventional loans, zero down payment requirement, flexible credit requirements, and no private mortgage insurance (PMI).

#1 Benefit: No Down Payment

USDA loans are one of the few mortgage options that don't require a down payment, making homeownership more accessible for eligible buyers.

However, not all USDA loans are the same. The program offers two main types each with its own eligibility requirements, including income limits and property location restrictions.

How do USDA loans work?

There are two types of USDA loans: USDA guaranteed and USDA direct.

USDA guaranteed loans are issued by private lenders and backed by the USDA, meaning the USDA covers a portion of the lender's losses if a borrower defaults, while USDA direct loans are funded directly by the U.S. Department of Agriculture, offering low-interest financing to qualifying low-income borrowers.

USDA loan requirements differ depending on the type of loan. Let's take a look at how they compare:

USDA Guaranteed vs. USDA Direct

| USDA Guaranteed Loan | USDA Direct Loan | |

|---|---|---|

| Funding | Private lenders, guaranteed by USDA | U.S. Department of Agriculture (USDA) |

| Income Eligibility | Household income is no more than 115% of the area’s median income | Household income is no more than 50-80% of the area’s median income |

| Credit Score Requirement | Determined by lender (typically 620+) | No minimum score, but must demonstrate repayment ability |

| Down Payment | Not required | Not required |

| Rates | Typically lower than conventional loans | Determined by USDA - typically lower than market rates |

| Guaranteed Fee | 1% upfront and 0.35% annually | Not required |

Due to their stricter eligibility requirements, USDA direct loans are much less common than guaranteed loans. To qualify for a USDA direct loan, a borrower must earn income below the "low" or "very-low" thresholds (50-80% of the area’s median income) and lack access to "decent, safe and sanitary" housing. USDA direct loan funding is also limited and distributed based on need and availability.

With direct loans, the USDA takes on the role of a mortgage lender. That's why Neighbors Bank specializes in USDA guaranteed loans.

To apply for a USDA direct loan, you can contact your local USDA office.

Do USDA loans have PMI?

Instead of private mortgage insurance, borrowers of USDA guaranteed loans are required to pay an upfront and annual guarantee fee. The guarantee fee goes straight to the Department of Agriculture to cover any losses caused by borrowers defaulting on loans. The USDA acts as a middleman between the buyer and lender when it comes to mortgage insurance.

The upfront USDA fee is 1% of the loan amount, while the annual fee is 0.35% of the remaining loan amount. The annual fee is divided by 12 and added to your monthly mortgage payment.

Neighborly AdviceThough it's called the "upfront fee," it is typically financed into the loan amount. But, if you'd like, you can pay it in cash at closing instead. It's also possible to use excess seller credit as negotiated in the contract to cover all or a portion of this fee.

Matt Roy, Underwriter

Matt Roy, Underwriter

Unlike PMI on conventional loans, the annual USDA fee is not cancelable and remains for the life of the loan.

USDA Loan Borrower & Property Requirements

Unless you're applying for a USDA loan directly with the USDA office, you're applying for a USDA guaranteed loan, which has different eligibility requirements than USDA direct loans.

Neighbors Bank offers USDA guaranteed loans, which have distinct eligibility requirements for the individual borrower and the property they want to purchase.

USDA Borrower Requirements

To be eligible for a USDA loan, a borrower must:

- Be a U.S. citizen or permanent resident

- Have a 620+ credit score (typically, lenders may allow compensating factors)

- Not have too much debt (DTI ratios are flexible)

- Not exceed local USDA income limits or 115% of their area's median income

- All applicants must plan to live in the home as their primary residence

Neighborly AdviceThe USDA has no credit score requirement. A lower credit score may impact qualification and require additional compensating factors, but it is solely up to the lender to decide. Additionally, a debt-to-income (DTI) ratio of 41% is only a requirement of the USDA's Automatic Underwriting System, which may result in a more streamlined loan approval. At Neighbors Bank, we don't have a fixed DTI requirement for USDA loans at all.

Matt Roy, Underwriter

Matt Roy, Underwriter

USDA Property Requirements

For a property to qualify for USDA financing, it must be a single-family home that satisfies the USDA's minimum property requirements. You cannot use USDA loans for multi-unit properties, investment properties, or vacation homes. You also must intend to occupy the property.

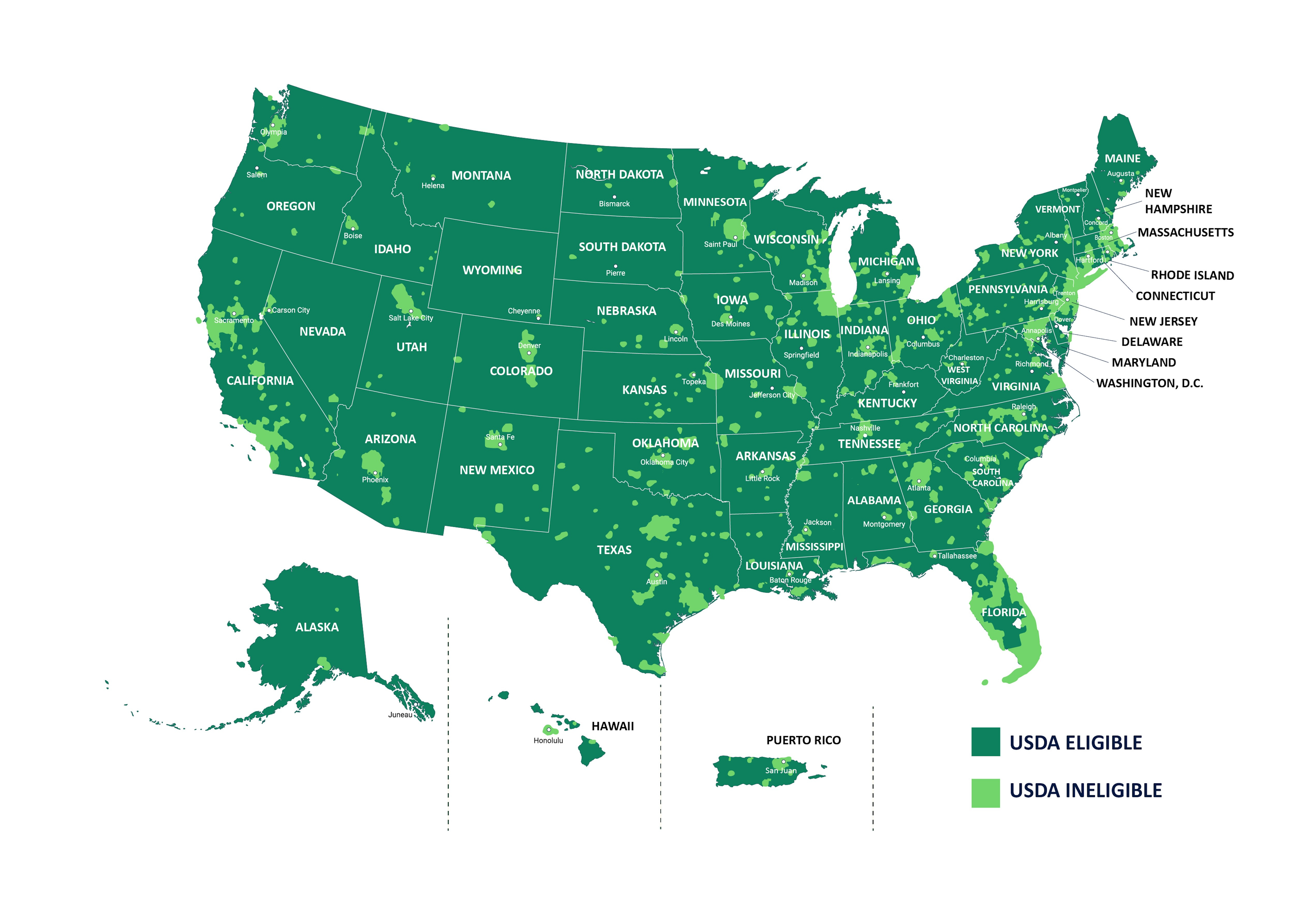

USDA-eligible properties also must be located in a designated rural area. Don't let the word "rural" discourage you. The USDA bases its definition on things like population size, proximity to cities, and access to home loans—not just farmland or remote areas. The good news? Nearly 97% of the U.S. qualifies!*

USDA Loans vs. Other Mortgage Types

Let's take a look at how USDA loans compare to other mortgage options:

| USDA Loans | Conventional Loans | VA Loans | FHA Loans | |

|---|---|---|---|---|

| Down Payment | No down payment required | 3% to 20% down payment | No down payment required | Typically 3.5%, 10% if credit score is below 580 |

| Credit Score | Typically 620+ | Typically 620+ | Typically 620+ | 500 (with 10% down) Otherwise 580+ but most lender require a minimum of 620 |

| Mortgage Insurance or Fees | Upfront guarantee fee and annual fee | PMI required with less than 20% down payment | Upfront fee that varies | MIP is required upfront and annually |

| Loan Limits | None | Varies by county | None | Varies by county |

| Income Limits | 115% of median area income | None | None | None |

| Property Eligibility | Must be in a designated rural area | No property restrictions | No property restrictions | No property restrictions |

| Occupancy Requirements | Primary residences | Primary, secondary, or investment properties | Primary residences | Primary residences |

USDA loans stand out from other mortgage options by offering zero down payment, competitive interest rates, and no ongoing mortgage insurance.

However, they also have specific eligibility requirements, including location restrictions and income limits. For those who qualify, USDA loans can be one of the most affordable ways to achieve homeownership.

How to Get a USDA Loan

To qualify for a USDA loan, first confirm that your income and the home's location meet USDA eligibility requirements. USDA considers the total income of all adults in the household, not just the applicant or co-applicants.

Next, find a USDA-approved lender to get preapproved and determine how much you can borrow. You can compare lenders to find the best fit. A loan expert can also help verify your income and property eligibility and determine how much you can afford to borrow.

Once preapproved, you can start house hunting in eligible areas. After choosing a home, your lender will manage the loan process, including the USDA appraisal, underwriting, and final approval.

Neighbors Bank is proud to be a Top 3 USDA Lender. We believe that homebuying should be accessible for everyone, and offer guidance throughout the entire process. We're here to ensure a smooth transition to your new home. Get started today!

Sources:

https://www.rd.usda.gov/browse-state

https://www.rd.usda.gov/media/file/download/sfh-lenderrankings.pdf

* Based on the Housing Assistance Council's tabulations of the U.S. Census Bureau's 2020 Census of Population and Housing and USDA data.