FHA Loan Requirements

FHA loans are one of the most common types of mortgage loans out there — and for many reasons. They’re good for first-time homebuyers, have low credit scores and down payment requirements, and are widely available.

But FHA loans aren’t right for everyone. If you’re considering an FHA loan for your home purchase or refinance, here’s what you should know about how they work and when they might be right for you.

FHA loans are a type of mortgage backed by the U.S. government meant to make homeownership more accessible for U.S. citizens. In 2025, FHA loans have the following requirements:

- Down Payment Minimum: 3.5%

- Credit Score Minimum: 580 or above but it varies by lender*

- Debt-to-Income Ratio Maximum: flexible, though 43% or lower is preferred

- You must pay a monthly Mortgage Insurance Premium (MIP)

- You can only use an FHA loan for a primary residence for 1-4 unit properties.

- FHA loans have loan limits that vary by the location you’re buying.

*Neighbors Bank typically requires a minimum credit score of 620.

Note: It is possible to qualify for an FHA loan with a credit score of 500-579 if you provide a down payment of 10% or more, however, this is ultimately up to your lender.

How do FHA loans work?

The Federal Housing Administration doesn’t actually issue FHA loans. Instead, it guarantees them, which means it offers to repay the lender a portion of the loan balance if the borrower fails to repay. This takes some of the risk off the lender’s shoulders and allows them to be a little less strict in who they loan to compared to other loan programs. This helps lenders offer less strict credit scores, consumer debt limits, and down payment requirements than other loan options.

In order to guarantee a loan, the FHA requires borrowers to meet certain requirements, and the property they’re buying must adhere to specific standards. Additionally, only FHA-approved lenders can issue FHA loans.

2025 FHA Loan Requirements

To qualify for an FHA loan, all buyers must meet a few key

requirements:

- You must be a legal U.S. citizen, permanent resident, or legal non-permanent resident

- You must be using the home as your primary residence

- You must move into the home within 60 days of closing

In addition to these criteria, the FHA sets minimum down payment and credit score standards. However, lenders have the discretion to enforce stricter financial requirements if they choose.

Down Payment of 3.5%

The lowest down payment possible on an FHA loan is 3.5% of the loan amount, but you must have a 580 or higher credit score to do so. If your score is in the 500-579 range, a 10% down payment is required.

Minimum Credit Score of 500

Lenders technically set their own credit score standards for FHA loans, but the minimum score required by the FHA is 500. Again, you’ll need at least a 10% down payment for this to be acceptable.

That being said, most lenders require scores above 600 for FHA loans (and all types of mortgage loans). If your credit score is below this threshold, you may have trouble finding a lender willing to work with you.

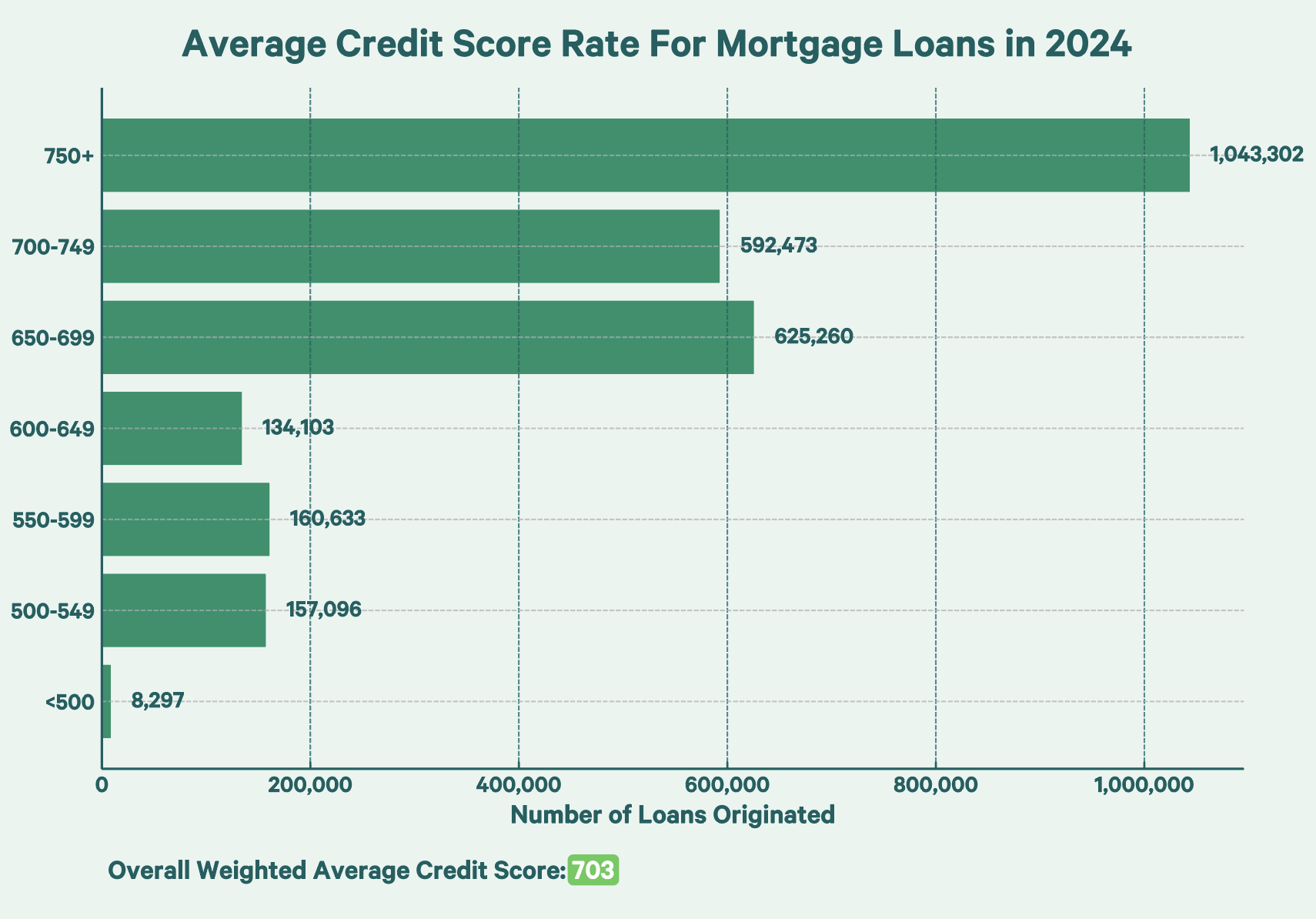

According to 2024 HMDA data, most home loan buyers had a credit score of 650+, with the average credit score being 703.

Neighbors Bank typically requires a minimum credit score of 620. Worried that your score is too low? We offer free credit counseling. Get started here!

Steady Income and Employment

You need steady income and employment, typically at least two years of income in the same line of work, to get an FHA loan. This shows the lender that you can make your payments consistently and repay your loan as agreed upon.

To prove your income, you usually need to provide pay stubs, W-2s, tax returns, and bank statements to prove your income. Your employer must also verify your employment. Lenders often request a Verification of Employment form from the borrower’s employer. This document confirms key details such as your job title, employment status, hire date, and salary.

Flexible DTI Ratio

FHA Loans have flexible debt-to-income (DTI) ratio requirements, though a ratio of 43% or lower is typically preferred. If your DTI ratio is above 43%, it is very possible to still qualify, but your lender may require additional documents.

Your DTI ratio helps lenders understand what percentage of your monthly income will go toward housing expenses. Lenders use two DTI ratios: front-end and back-end. The front-end DTI ratio shows the lender what percentage of your monthly income will go toward housing expenses, while the back-end DTI ratio shows how much of your monthly income is taken up by debt payments.

Upfront and Monthly Mortgage Insurance Premiums (MIP)

FHA loans require a mortgage insurance premium — both upfront (at closing) and as part of your monthly payment. FHA mortgage insurance is paid to the FHA, which uses the funds to cover potential losses if a borrower defaults on their loan.

Upfront MIP is equal to 1.75% of the loan amount, which you can either pay at closing or roll into your loan amount.

In addition, there is a monthly MIP, which ranges from 0.15% to 0.75% of the loan amount, depending on your original loan size, term, and down payment. If you make a down payment of 10% or more, you can cancel MIP after 11 years. Otherwise, you have to pay MIP for the life of the loan.

FHA Loan Limits

FHA loans also have loan limits that vary by location and change annually. Loan limits are the maximum amount a borrower can finance through certain types of loans. The FHA sets these limits, and they vary by location based on local housing market prices.

In most parts of the country, the loan limit for 2025 on a single-unit home is $524,225. In higher-cost housing markets, the limit is $1,209,750.

You can see the FHA loan limit for any property using this tool.

FHA Appraisal & Property Requirements

FHA also has requirements for the properties you purchase with these loans. For one, you can only use FHA loans on a home intended as your primary residence. That means you can’t buy a rental home or investment property using an FHA loan. The one exception is if you purchase a multi-unit property, live in one unit, and rent out the rest.

Homes must also meet FHA’s minimum property standards, which ensure the place is safe and hazard-free and that the home is a good long-term investment. Your lender will require an FHA appraisal of the home to ensure it meets these standards and to assess its current market value during the application process.

FHA Home Loan Types

Under the FHA loan umbrella, you’ll find several options tailored to your needs. Whether you’re purchasing a home, making repairs, or looking to refinance your FHA loan, there’s a loan type designed to help you achieve your goals.

Here are some of the most popular FHA mortgage options:

| FHA Loan Type | Purpose |

|---|---|

| FHA Purchase Loan | To purchase a one- to four-unit property |

| FHA Streamline Refinance | Replaces your current FHA loan with a new one (with a new term and interest rate) using a streamlined process, typically avoiding a new appraisal and document check. |

| FHA Cash-Out Refinance | Replaces your current loan with a new, larger one while you get the difference back in cash. Cash-out refinances are also used to refinance non-FHA loans into FHA loans. |

| FHA 203(k) Renovation Loan | To purchase a one- to four-unit property and finance the cost of home repairs and upgrades |

| FHA New Construction Loan | To purchase a one- to four-unit property plus property and finance the cost of the home build |

| FHA Energy Efficient Mortgage | To purchase a one- to four-unit property and finance the cost of energy upgrades |

Who are FHA loans good for?

FHA loans are generally a good option for first-time homebuyers and borrowers with limited savings or lower credit scores. The FHA’s guarantee allows lenders to be more lax with their financial requirements, so they can be good options if you’re worried about qualifying for another loan program due to high debt levels or a less attractive credit score.

How to Get an FHA Loan

If you’re considering an FHA loan, the first step is to reach out to an FHA-approved lender to check your eligibility.

To get started, reach out to one of our FHA loan specialists. They can walk you through the requirements of our FHA loan options and guide you through the application process from start to finish.

FHA Loan FAQs

How long does it take to get approved?

It takes about 40 to 50 days from application to closing on an FHA loan. This is slightly longer than it takes to close on a conventional loan.

What are the costs of getting an FHA loan?

Yes, FHA loans come with closing costs, as with any other mortgage program. You also owe an upfront mortgage insurance premium (MIP) and an FHA appraisal fee. FHA loans require monthly MIP as well. This lasts for at least 11 years (or sometimes the life of the loan, depending on the size of your down payment).

What will disqualify you from an FHA loan?

While the FHA sets minimum financial requirements, at the end of the day, it’s up to lenders to accept you or not. If you don’t meet a lender’s financial requirements, you will not qualify for an FHA loan. However, lender requirements vary, so it’s important to shop around.

Additionally, if you’ve had a bankruptcy within the past 2 years or a foreclosure within the past 3, there may be a required waiting period before you’re eligible to apply.

Are you eligible for a FHA home loan?

Talk to one of our loan experts to see if you qualify.

Get started