Gift funds can play a vital role in helping borrowers achieve their homeownership dreams while utilizing USDA loans. These funds refer to monetary gifts given to a homebuyer that can be used to help pay for a down payment, closing costs, or other expenses when purchasing a home. Though USDA loans don’t have a down payment requirement, you still have to cover closing costs, and you could choose to provide a down payment in order to build equity.

Can You Use Gift Funds on USDA Loans?

Yes, gift funds can be used with USDA loans. However, you must follow specific guidelines and requirements to ensure a smooth transaction.

Who Can Provide Gift Funds for a USDA Loan?

Anyone can provide a gift fund for a USDA loan as long as they are not involved in the real estate transaction. For example, home sellers, agents, builders and mortgage lenders are not valid gift fund sources.

Commonly approved sources of gift funds include:

Family members

Friends

Church

Employer or labor union

Charitable organization

Homeownership assistance grants and programs

What Can USDA Gift Funds Be Used For?

Here are common acceptable uses of USDA loan gift funds:

Optional Down Payment: Even though USDA loans offer 100% down payment financing, some borrowers choose to contribute a small down payment to reduce their loan amount.

USDA Closing Costs: Like any mortgage loan, USDA loans come with closing costs. Gift funds may be used for appraisal fees, lender fees, title charges and other closing costs.

Optional Earnest Money Deposits: USDA loans don’t require earnest money deposits, but making one can help show a seller your serious intent. Gift funds can be used for this as long as they're fully documented.

Mortgage Rate Buydowns: Using gift funds for temporary or permanent interest rate buydowns can help lower your monthly payment.

Debt Payoff at Closing: If you’re having to pay off a debt to qualify, the funds used for the payoff can come from a gift.

Using gift funds for any of these costs requires proper documentation showing exactly where the funds came from, how they were transferred, and that they don’t need to be repaid.

Neighborly Advice

Gift fund money can be received by the borrower or the party responsible for the fee. For example, a family member wanting to provide money to help with the title fee could make the check out to the title company. Any leftover funds would be returned to the borrower.

USDA Gift Fund Requirements

When using gift funds in the USDA loan process, thorough documentation is essential to satisfy lender requirements. Make sure you’re prepared for the following:

| Requirement | Explanation |

|---|---|

| No Repayment Expected | The funds must be a bona fide gift, not a hidden loan. Any informal agreement for repayment is considered mortgage fraud. |

| Acceptable Donor | The donor must be an approved source. Any party with a financial interest in the transaction is generally prohibited from providing a gift fund. |

| Primary Residence | USDA loans are only intended to finance primary residences, so gift funds cannot be used for vacation homes or investment properties. |

| Document the Transfer | Lenders require documentation to ensure that the funds used for a USDA loan come from a legitimate and legally obtained source. |

| No Cash | The transfer of funds should be traceable, such as via a check or wire transfer. Physical cash is generally not permitted. |

Gift Fund Letter Requirements

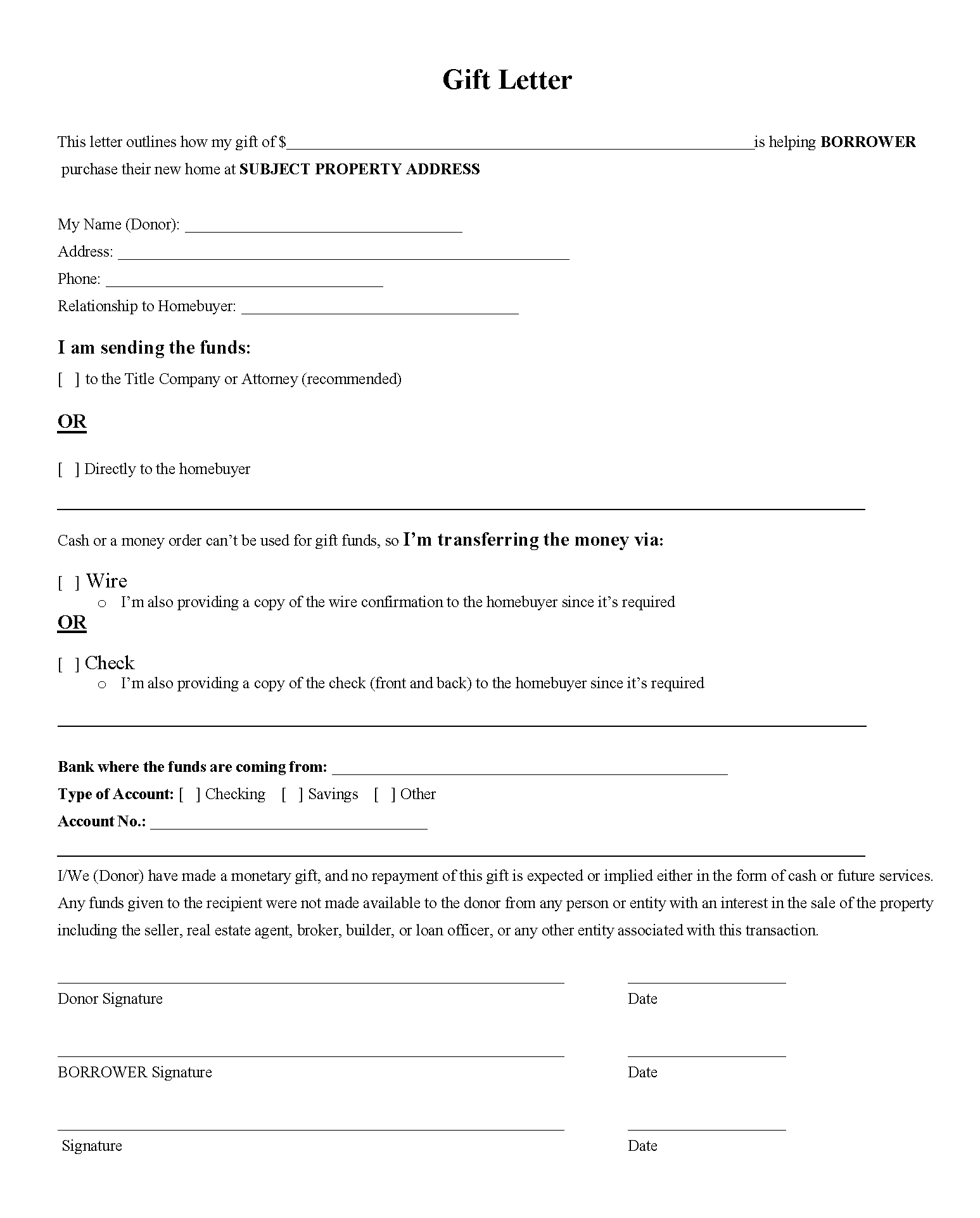

A gift letter is a signed statement provided by a donor to the lender and is a required part of the gift fund process. The letter should provide detailed information about your donor, including their name, relationship to you, and contact information. The letter also must affirm that the funds are a gift and there is no expectation of repayment. The donor must prove that the gift funds originate from their bank account and document the transfer of funds via check, electronic transfer, or wire.

Note that individual lenders may have their own specific guidelines for gift funds. Consult with your loan officer to ensure compliance with their requirements.

Example Gift Fund Letter

Here’s an example of what an acceptable gift letter looks like and the information that it should include:

Do USDA loan gift funds have any tax implications?

Generally, gift funds are not tax-deductible for the donor, and the recipient does not have to pay income tax on the funds.

However, the donor may be liable for the federal gift tax if the donation exceeds the annual exclusion amount. For 2026, the annual federal gift tax exclusion is $19,000, so as long as the donation is below that amount, the donor will not owe gift taxes. It is advisable to consult a tax professional for specific advice.

More Questions?

If you are considering using gift funds at any point while acquiring a USDA loan, it’s a good idea to consult your lender as soon as possible. For more information about USDA gift funds guidelines and requirements, get started today, and a Neighbors Bank home loan specialist will be in touch.