Prequalification and preapproval are both steps in the USDA loan process, but they are not the same. Prequalification gives you a general idea of how much home you can afford. It’s based on estimates you provide, like your income and debts, and helps determine if you meet basic eligibility requirements.

On the other hand, preapproval is more detailed and involves submitting official documents, such as pay stubs and W-2s, so a lender can verify your financial situation.

Why Prequalification vs. Preapproval Matters

Prequalification and preapproval are part of the process for any mortgage—not just USDA loans. Prequalification is an early, informal estimate of your homebuying budget and eligibility. Since it’s based on self-reported info, it’s less accurate. Preapproval gives a much clearer, verified picture of what you can actually borrow because the lender has reviewed your documents.

Sellers and agents take preapproval more seriously because it shows you're a serious, qualified buyer.

Neighborly Advice

Your preapproval letter helps demonstrate to sellers that you are a serious buyer. It will include your estimated loan amount and interest rate, however, keep in mind that your interest rate is not final until you lock it in with your lender.

USDA Loan Prequalification

Prequalification can typically be completed in minutes, online or over the phone. At Neighbors Bank, you can check your prequalification online in minutes.

Prequalification happens soon after a borrower submits their application to a USDA-approved lender. Lenders will also ask for additional information to make sure you meet basic USDA loan eligibility requirements.

Like other mortgage loans, USDA eligibility requirements address key areas like price range, location, and your overall financial health:

Desired house price

Desired loan term

Desired property type

The property's intended use

Income

Assets

Debts

Credit score

Unlike other mortgages, USDA loans have property eligibility and income limits that must be met in order to prequalify. Your household income cannot exceed the limit to qualify for a USDA loan. USDA income limits vary by household size and where you plan to purchase.

Additionally, the property must also be located in an eligible rural or suburban area that the USDA allows.

Prequalification is a preliminary step and does not guarantee your approval for a USDA loan. Preapproval is given when your lender accepts the documentation you provide to support the income, credit, and assets on your application.

USDA Loan Preapproval

Preapprovals for USDA home loans can only be issued by USDA-approved lenders.

Preapproval can happen within as little as 1 to 3 days in most cases and will typically be issued once your lender receives the following supporting documentation:

Proof of income using pay stubs, tax returns, W-2s, and bank statements.

Employment verification may be provided through documentation such as a letter from your employer or recent pay stubs.

Credit history requires authorization for the lender to pull your credit report and provide documentation to support any outstanding debts or credit issues.

Asset documentation showing reserves with bank, investment, or retirement account statements.

Other documentation at your lender’s discretion to verify your identity or any incomplete information from your application, such as a copy of your driver's license or social security card.

Once you have provided all the required documentation, the lender will review your application and determine if you meet the eligibility requirements for a USDA loan. Upon meeting the necessary preapproval criteria, the lender will provide a letter outlining your estimated loan amount and potential loan terms.

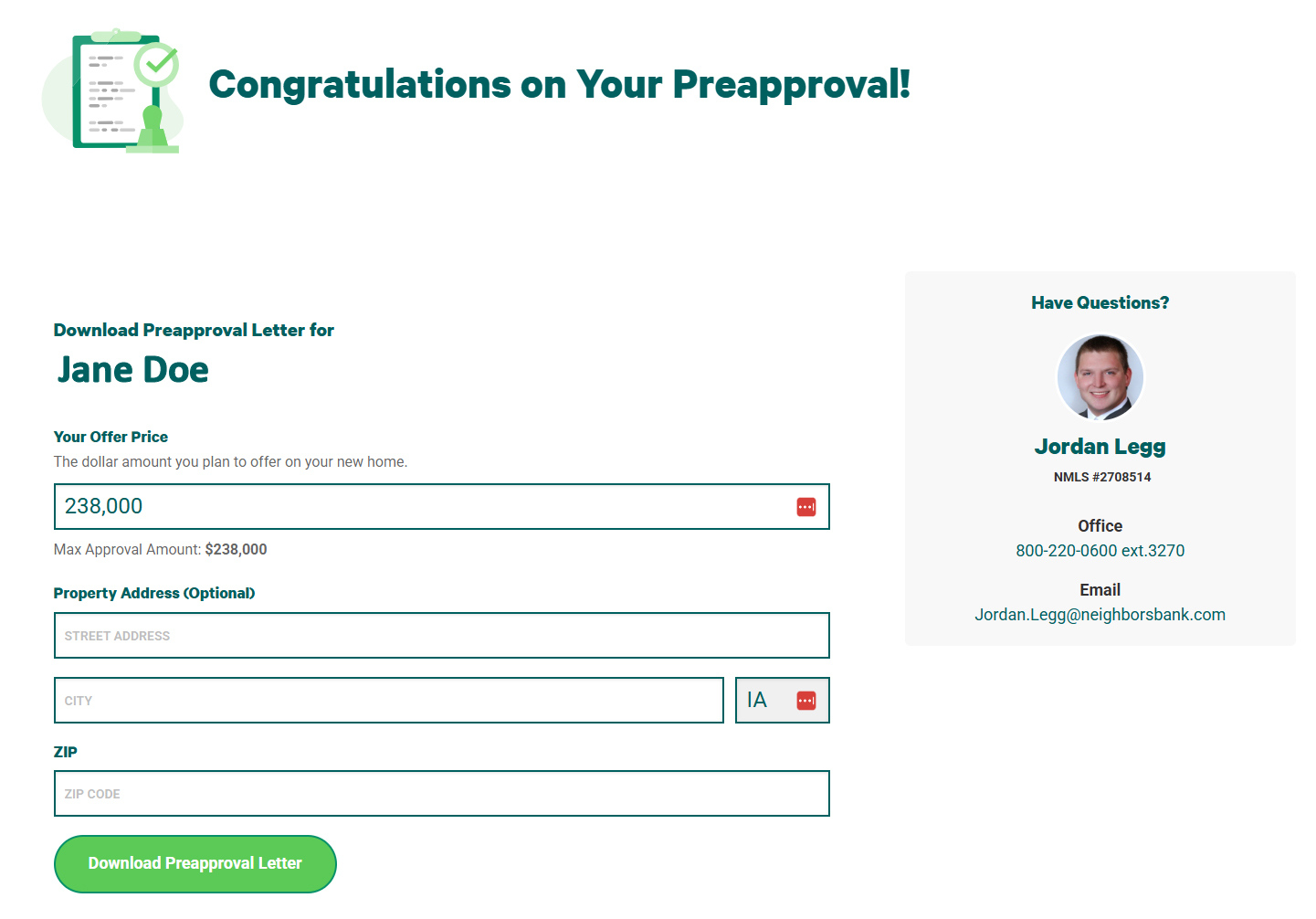

Example Preapproval Letter

Preapproval letters will generally include the borrower’s name, the loan amount they are approved for, your loan expert’s name and contact information, the date the letter was issued, and the period of time the preapproval is valid.

Here is what a typical Neighbors Bank preapproval letter looks like.

How long does preapproval take?

If you have your paperwork (like pay stubs, W-2s, tax returns, bank statements, and ID) ready, many lenders can issue a preapproval within 24 hours. Some even do it the same day.

If the lender needs extra documentation or if your financial situation is more complex (for example, you're self-employed or have multiple income sources), it may take several days.

What if I’m not approved?

USDA loan applications can be denied in some instances. Beyond the financial side of your loan application, property location and condition can be reasons for denial.

Here's a great guide on common USDA denial reasons and potential solutions.

A USDA loan isn’t suitable for everyone. Qualifying can be difficult because there are specific income, location, and property requirements. Luckily, there are other loan options that might better fit different financial situations and needs.

A Neighbors Bank loan expert can help you find the best loan for you. Get started online, and someone will contact you soon.