USDA Loan Credit Score Requirements

The USDA home loan program offers affordable financing to low- to moderate-income homebuyers. However, credit score requirements vary by lender, and while the USDA itself does not impose a strict minimum, understanding these guidelines is essential.

Let’s break it down.

What is the minimum credit score for a USDA loan?

USDA direct and USDA guaranteed loans have no set credit score minimum.

USDA direct loans have no minimum credit score requirement and are available only through the USDA for very low- and low-income borrowers.

USDA guaranteed loans, offered by USDA-approved private lenders, typically require a minimum credit score of 620, though requirements vary by lender.

✅ Neighbors Bank typically requires a minimum FICO score of 620.

If your credit score is below 620, it will be difficult to receive loan approval, however, it still may be possible if you have other strong financial factors to compensate for a lower score.

Neighbors Bank offers free credit consulting to borrowers who don't meet our credit requirements. Get in touch today!

Why do some lenders require a 640 credit score for USDA loans?

Most private USDA lenders use the USDA Guaranteed Underwriting System (GUS) to evaluate a borrower’s risk and loan eligibility. To get automatic GUS approval, borrowers must have a 640 credit score or higher with no outstanding federal judgments or significant delinquencies.

How to Qualify for a USDA Loan with a Low Credit Score

If your credit score is below 640 and you do not receive an automated accept from GUS, your lender can still manually underwrite your USDA loan application.

Manually underwritten applications typically require other strengthening income or asset information in your application. These factors give strength and showcase your ability to repay the loan, such as:

- A current mortgage or rent payment that is higher than what your new mortgage will be

- Cash reserves or other assets

- A low debt-to-income ratio

- A stable, consistent employment history

Lenders call these “compensating factors,” which give extra assurance you can repay the loan, even if you have a less-than-perfect credit score.

Getting a USDA Loan with No Credit History

If you’ve never taken out a loan or credit card to establish credit scores, you’ll need to document your ability to make payment obligations in another way, using what underwriters refer to as “non-traditional tradelines.”

Documenting a non-traditional tradeline requires a track record of making on-time payments for at least 12 consecutive months.

Here are some common ways that borrowers can prove a history of on-time payments:

- Rent payments

- Utilities (water, power, internet, cable)

- Auto or Renters Insurance

- Monthly childcare

- School tuition or educational costs

- Phone bill (cell or landline)

- Gym memberships

Ultimately, the stronger your track record of paying your monthly obligations, the better your chance of loan approval, even without an established credit history.

How Mortgage Credit Scores Are Determined

Credit scores are a numerical indication of your financial habits, typically ranging from 300 to 850. A higher score points to on-time bill payments and smart management of your finances overall. A lower score indicates less responsibility with credit and may pose more risk to a mortgage lender.

Mortgage lenders typically use a borrower's middle credit score from the three major credit bureaus—Experian, Equifax, and TransUnion—to assess credit risk and determine loan eligibility.

FICO scores, developed by the Fair Isaac Corporation, are the most commonly used credit scores in lending decisions. These scores are calculated based on credit data from each bureau, but because lenders report information differently, a borrower's credit score may vary between the three bureaus.

FICO scores are based on these five items:

- Length of credit history

- Payment history

- Total amount owed

- Types of credit

- Credit inquiries in your name

To be clear, there isn’t one single credit score. Since FICO scores are calculated based on the information in each bureau's report, a borrower may have three different FICO scores, one from each bureau. All three credit bureaus calculate scores in slightly different ways, and USDA lenders consider the middle score of these three when evaluating your application. In instances when only two scores are present, they'll use the lower of the two.

How to Improve Your Score for a USDA Loan

If your credit scores are not where they need to be for a USDA loan, there are ways to improve them.

- Make all payments on time – Payment history is the most significant factor in your credit score. If you have any past-due accounts, make them current as soon as possible.

- Reduce credit utilization – Pay down existing credit card balances and aim to keep usage below 30% of your total credit

limit.

- Avoid opening new credit accounts – Hard inquiries and new credit lines can temporarily lower your score, so only take on new credit when necessary.

- Check your credit reports regularly – Review reports from Experian, Equifax, and TransUnion to identify and dispute any errors that may be lowering your score.

- Keep older accounts open – A longer credit history can positively impact your score, so avoid closing old accounts unless absolutely necessary.

Following these steps can improve your creditworthiness and increase your chances of qualifying for a USDA loan with better terms.

USDA Credit Requirements vs. Other Mortgages

While there are other mortgage programs like FHA loans, which are known forhaving especially low credit score requirements (as low as 500 with a 10% down payment), you should note that they still are up to individual lenders’ discretion.

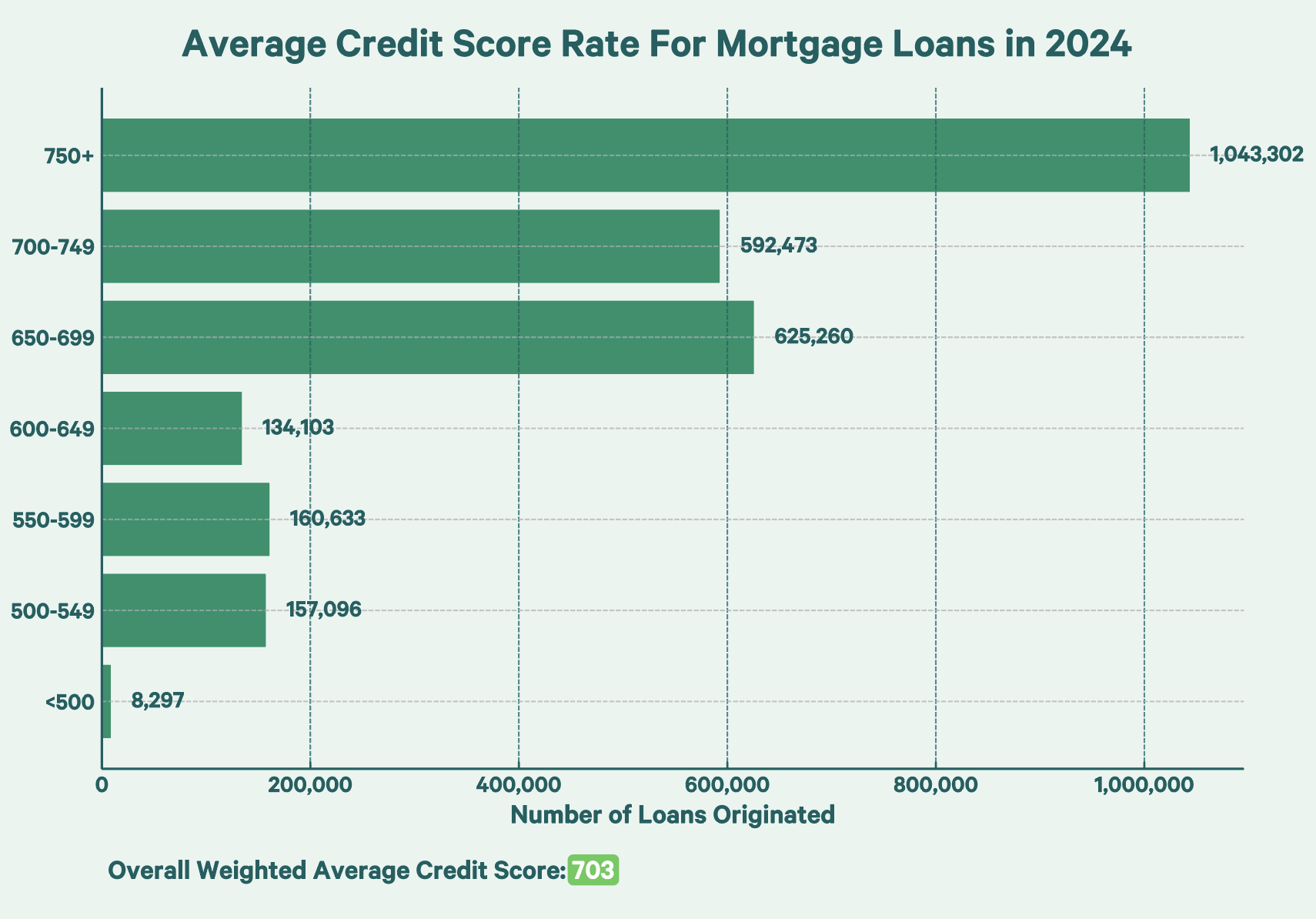

Average credit score data across government-backed and conventional loan data for 2024 shows how difficult it can be to get any mortgage with a score below 650.

If you have a flexible buying timeline, improving your credit score before applying for a USDA loan is worthwhile. Not only will it increase your approval chances, but it will directly result in a lower USDA loan rate.

Are you eligible for a USDA home loan?

Talk to one of our USDA experts to see if you qualify.

Get started